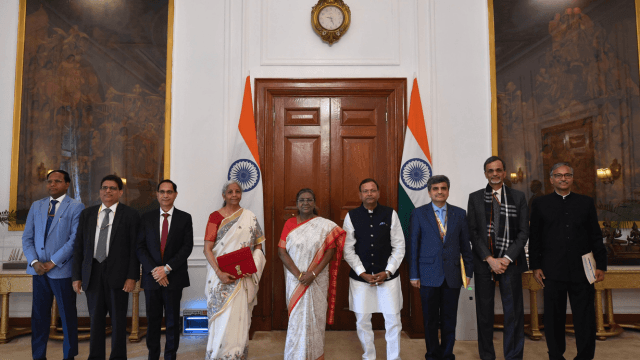

Budget 2025-2026 the complete Nirmala Sitharaman budget Speech and highlights of Budget

Introduction

1. This Budget represents our Government’s ongoing commitment to:

a) accelerate economic growth,

b) ensure inclusive development,

c) stimulate private sector investments,

d) bolster household confidence, and

e) enhance the purchasing power of India’s burgeoning middle class.

2. Together, we are embarking on a journey to unlock our nation’s immense potential for greater prosperity and strengthen our position on the global stage, all under the leadership of Hon’ble Prime Minister Shri Narendra Modi.

3. As we navigate the first quarter of the 21st century, we face ongoing geopolitical challenges that may lead to subdued global economic growth in the coming years. However, our vision for a Viksit Bharat propels us forward, guided by the transformative work we have accomplished during our Government’s first two terms.

Budget 2025-2026 Theme

4. Our economy is the fastest-growing among major global economies. Over the past decade, our development and structural reforms have captured global attention. Confidence in India’s capabilities and potential has strengthened during this time. We view the next five years as a unique opportunity to achieve ‘Sabka Vikas’, nurturing balanced growth across all regions.

5. The esteemed Telugu poet and playwright Gurajada Appa Rao wisely stated, ‘Desamante Matti Kaadoi, Desamante Manushuloi,’ which means ‘A country is not just its soil; a country is its people.’ In this spirit, our vision for Viksit Bharat includes:

a) Eradicating poverty;

b) Providing quality school education for all;

c) Ensuring high-quality, affordable healthcare for everyone;

d) Creating a workforce that is fully skilled and meaningfully employed;

e) Encouraging 70% of women to participate in economic activities; and

f) Supporting farmers to position our nation as the ‘food basket of the world.’

6. In this Budget, we propose developmental initiatives across ten key areas, focusing on the underprivileged, youth, farmers, and women. These areas are:

1) Enhancing agricultural growth and productivity;

2) Fostering rural prosperity and resilience;

3) Promoting inclusive growth for all;

4) Boosting manufacturing and promoting the Make in India initiative;

5) Supporting micro, small, and medium enterprises (MSMEs);

6) Facilitating employment-driven development;

7) Investing in people, the economy, and innovation;

8) Securing energy supplies;

9) Encouraging exports; and

10) Fostering innovation.

7. Our development journey will be powered by:

a) Four key engines: Agriculture, MSME, Investment, and Exports

b) Fueled by our Reforms

c) Guided by the principle of Inclusivity

d) With the ultimate goal: Viksit Bharat

8. This Budget seeks to initiate transformative reforms across six critical domains. Over the next five years, these reforms will enhance our growth potential and global competitiveness. The focus areas include:

1) Taxation;

2) Power Sector;

3) Urban Development;

4) Mining;

5) Financial Sector; and

6) Regulatory Reforms.

Agriculture as Our Leading Force

9. Let’s delve into some specific initiatives, starting with the concept of ‘Agriculture as Our Leading Force’.

Prime Minister Dhan-Dhaanya Krishi Yojana – Developing Agri Districts Program

10. Inspired by the success of the Aspirational Districts Programme, our government is launching the ‘Prime Minister Dhan-Dhaanya Krishi Yojana’ in collaboration with state governments. This initiative will bring together various existing schemes and targeted actions to improve conditions in 100 districts facing low productivity, moderate crop intensity, and below-average credit access. The program aims to: (1) boost agricultural productivity, (2) promote crop diversification and sustainable farming practices, (3) enhance post-harvest storage at both panchayat and block levels, (4) strengthen irrigation infrastructure, and (5) improve access to both long-term and short-term credit. This initiative is projected to benefit around 1.7 crore farmers.

Building Rural Prosperity and Resilience

11. We will also introduce a comprehensive multi-sectoral ‘Rural Prosperity and Resilience’ program, working in partnership with states. This initiative will tackle underemployment in agriculture through skill development, investment, technology adoption, and by revitalizing the rural economy. Our objective is to create substantial opportunities in rural areas, where migration becomes a choice rather than a necessity.

12. The program will prioritize rural women, young farmers, rural youth, marginal and small farmers, and landless families. Detailed information is available in Annexure A.

13. We will integrate global and domestic best practices, and seek appropriate technical and financial support from multilateral development banks. In the first phase, we will target 100 developing agri-districts.

Aatmanirbharta in Pulses

14. Our government is advancing the National Mission for Edible Oilseeds to ensure self-sufficiency in edible oils. Our farmers possess the capability to meet our requirements and more.

15. A decade ago, we collectively made strides toward near self-sufficiency in pulses, leading to a remarkable response from farmers who expanded their cultivated area by 50%. The government played its part by arranging for procurement and offering fair prices. As incomes have risen and accessibility has improved, our consumption of pulses has surged significantly.

16. To further this progress, our government will launch a 6-year “Mission for Aatmanirbharta in Pulses,” emphasizing Tur, Urad, and Masoor. Further details can be found in Annexure B. Central agencies, namely NAFED and NCCF, will be prepared to procure these three pulses from farmers who register with them and enter into agreements over the next four years.

Comprehensive Programme for Vegetables & Fruits

17. It’s encouraging to witness our community’s growing awareness of nutritional needs, signaling a positive shift towards a healthier society. As incomes rise, we’re noticing a notable uptick in the consumption of vegetables, fruits, and shree-anna. To support this progression, we are excited to introduce a comprehensive programme designed to boost production, ensure steady supplies, enhance processing methods, and secure fair prices for farmers, in partnership with state governments. Additionally, we’ll implement suitable institutional frameworks to promote active participation from farmer producer organizations and cooperatives.

Makhana Board in Bihar

18. We’re thrilled to bring a new opportunity to the people of Bihar with the establishment of a Makhana Board.This initiative is designed to enhance the production, processing, value addition, and marketing of makhana. Individuals involved in these processes will be organized into Farmer Producer Organizations (FPOs). The Board will provide essential guidance and training to makhana farmers, ensuring they can access all relevant government benefits.

National Mission on High Yielding Seeds

19. We’re preparing to launch a National Mission on High Yielding Seeds, which will concentrate on three key areas: (1) enhancing the research ecosystem, (2) developing and promoting high-yield, pest-resistant, and climate-resilient seed varieties, and (3) ensuring the commercial availability of over 100 seed varieties that have been released since July 2024.

Fisheries

20. India stands as the second-largest producer of fish globally, with seafood exports reaching an impressive ₹60,000 crore. To fully leverage the immense potential of our marine sector, the Government is set to establish a supportive framework aimed at sustainable fisheries management within the Indian Exclusive Economic Zone and High Seas. Special attention will be given to the Andaman & Nicobar and Lakshadweep Islands in this initiative.

Mission for Cotton Productivity

21. I am pleased to unveil a ‘Mission for Cotton Productivity’ that will benefit numerous cotton farmers. This five-year initiative is designed to significantly enhance productivity and sustainability in cotton farming while promoting extra-long staple cotton varieties. Farmers will receive exceptional support in science and technology, aligning with our comprehensive 5F vision for the textile sector, ensuring better incomes for farmers and a reliable supply of quality cotton to rejuvenate India’s traditional textile industry.

Enhanced Credit through KCC

22. Kisan Credit Cards (KCC) offer short-term loans to 7.7 crore farmers, fishermen, and dairy farmers. Under the Modified Interest Subvention Scheme, we will be increasing the loan limit from ₹3 lakh to ₹5 lakh for loans issued through KCC.

Urea Plant in Assam

23.To achieve self-reliance in urea production, our Government has revived three previously inactive urea plants in the Eastern region. Additionally, a new plant with an annual production capacity of 12.7 lakh metric tons is set to be established in Namrup, Assam.

India Post: A Driving Force for Rural Economy

24.With 1.5 lakh rural post offices and the India Post Payment Bank supported by a vast network of 2.4 lakh Dak Sevaks, India Post is being repositioned to be a key driver of the rural economy. More details on this initiative can be found in Annexure C.

25.India Post will also evolve into a comprehensive public logistics organization to address the growing demands of artisans, new entrepreneurs, women, self-help groups, MSMEs, and larger business entities.

Support for NCDC

26.Our Government is committed to providing support to the National Cooperative Development Corporation (NCDC) to enhance lending operations within the cooperative sector.

MSMEs: The Second Engine of Growth

27.Moving on to MSMEs, which serve as the second engine of our economy, this sector includes both manufacturing and services and is home to approximately 5.7 crore entities.

Revised Classification Criteria for MSMEs

28.Currently, over 1 crore registered MSMEs employing 7.5 crore individuals contribute significantly to our manufacturing sector, generating 36 percent of our output. These MSMEs play a crucial role in our exports, accounting for 45 percent of the total. To promote higher efficiencies, technological advancements, and easier access to capital, we will raise the investment and turnover limits for the classification of all MSMEs to 2.5 times and 2 times, respectively. This change will empower them to expand and create more job opportunities for our youth. Further details can be found in Annexure D.

Enhanced Credit Availability with Guarantee Coverage

29.To improve access to credit, we will expand the credit guarantee cover:

a) For Micro and Small Enterprises, the cap will increase from ₹5 crore to ₹10 crore, expected to generate an additional ₹1.5 lakh crore in credit over the next five years;

b) For Startups, the limit will rise from ₹10 crore to ₹20 crore, with the guarantee fee set at a moderate 1 percent for loans in 27 focus sectors critical to Atmanirbhar Bharat; and

c) For well-performing exporter MSMEs, terms loans will be available up to ₹20 crore.

Introduction of Credit Cards for Micro Enterprises

30. We will launch tailored Credit Cards with a limit of ₹5 lakh for micro enterprises registered on the Udyam portal, with an initial rollout of 10 lakh such cards in the first year.

Fund of Funds for Startups

31. The Alternate Investment Funds (AIFs) dedicated to startups have attracted commitments exceeding ` 91,000 crore, bolstered by a Fund of Funds established with a Government contribution of ` 10,000 crore. In addition, a new Fund of Funds is set to launch with an expanded focus, featuring an additional contribution of ` 10,000 crore.

Scheme for First-time Entrepreneurs

32. A new initiative will be introduced to support 5 lakh women, Scheduled Castes, and Scheduled Tribes who are first-time entrepreneurs. This initiative will offer term loans of up to ` 2 crore over the next five years, drawing on insights from the successful Stand-Up India program. There will also be opportunities for online capacity building in entrepreneurship and managerial skills.

Measures for Labour-Intensive Sectors

33. In our effort to foster employment and entrepreneurial growth within labor-intensive sectors, our Government plans to implement specific policies and facilitation measures.

Key Product Initiative for Footwear and Leather Industries

34. To boost productivity, quality, and competitiveness in India’s footwear and leather industries, a dedicated focus product scheme will be launched. This scheme will aid in enhancing design capacity, supporting component manufacturing, and providing the necessary machinery for the production of non-leather quality footwear, alongside support for leather footwear and products. It is anticipated that this initiative will create employment for 22 lakh individuals, generate turnover of ` 4 lakh crore, and lead to exports exceeding ` 1.1 lakh crore.

Measures for the Toy Sector

35. Expanding on the National Action Plan for Toys, we will roll out a scheme aimed at positioning India as a global toy hub. This initiative will concentrate on developing clusters, fostering skills, and establishing a manufacturing ecosystem to produce high-quality, unique, innovative, and sustainable toys that embody the ‘Made in India’ brand.

Support for Food Processing

36. Aligning with our commitment to ‘Purvodaya,’ we will establish a National Institute of Food Technology, Entrepreneurship, and Management in Bihar. This institute will significantly enhance food processing activities across the Eastern region, leading to (1) increased income for farmers through value addition to their products, and (2) opportunities for skilling, entrepreneurship, and employment for the youth.

Manufacturing Mission

Encourage “Make in India” Initiative

37. Our government is launching a National Manufacturing Mission to support the “Make in India” initiative across small, medium, and large industries. This mission will provide essential policy backing, detailed execution roadmaps, and a robust governance and monitoring framework for both central ministries and states. For more specifics, please refer to Annexure E.

Clean Tech Manufacturing

38. In line with our dedication to sustainable development, the Mission will also focus on Clean Tech manufacturing. This initiative aims to enhance domestic value addition and cultivate our ecosystem for solar PV cells, electric vehicle (EV) batteries, motors and controllers, electrolyzers, wind turbines, high voltage transmission equipment, and large-scale grid batteries.

Investment as the Third Driving Force

39. Now, let us discuss Investment as the third driving force, which includes investing in people, the economy, and innovation.

A. Investing in People

Saksham Anganwadi and Poshan 2.0

40. The Saksham Anganwadi and Poshan 2.0 program provides nutritional support to over 80 million children, 10 million pregnant women and lactating mothers across the nation, as well as around 2 million adolescent girls in aspirational districts and the northeastern region. The cost norms for this nutritional support will be appropriately enhanced.

Atal Tinkering Labs

41. In the next five years, we will establish 50,000 Atal Tinkering Labs in Government schools to nurture curiosity and innovation, encouraging a scientific mindset among our youth.

Broadband Connectivity for Government Secondary Schools and PHCs

42. Under the Bharatnet project, we will ensure that all Government secondary schools and primary health centers in rural regions gain access to broadband connectivity.

Bharatiya Bhasha Pustak Scheme

43. We propose the implementation of the Bharatiya Bhasha Pustak Scheme, aimed at providing Indian language books in digital format for school and higher education. This initiative will enhance students’ understanding of their subjects.

National Centres of Excellence for Skilling

44. Building on the initiatives outlined in the July 2024 Budget, we are excited to announce the establishment of five National Centres of Excellence focused on skilling. These centers will collaborate with global experts to empower our youth with the essential skills needed for “Make for India, Make for the World” manufacturing. Our partnerships will involve developing curricula, training trainers, creating skills certification frameworks, and conducting regular evaluations to ensure effectiveness.

Expansion of Capacity in IITs

45. Over the past decade, the student population across 23 IITs has surged by 100%, increasing from 65,000 to 135,000. We will enhance infrastructure in the five IITs inaugurated after 2014 to accommodate an additional 6,500 students, with particular expansions in hostel and other facilities at IIT Patna.

One of the key highlights will be the Centre of Excellence in AI for Education.

46. Following the announcement of three Centres of Excellence in Artificial Intelligence for agriculture, health, and sustainable cities in 2023, we will establish a Centre of Excellence in Artificial Intelligence for education, with a total investment of ₹500 crore.

Expansion of Medical Education

47. Our Government has successfully added approximately 1.1 lakh undergraduate and postgraduate medical education seats over the past ten years, marking a 130% increase. In the coming year, we will introduce an additional 10,000 seats in medical colleges and hospitals, contributing towards our goal of adding 75,000 seats over the next five years.

Day Care Cancer Centres in All District Hospitals

48. Our Government plans to establish Day Care Cancer Centres in all district hospitals within the next three years, with a target of launching 200 Centres by 2025-26.

Strengthening Urban Livelihoods

49. Supporting the urban poor and vulnerable communities remains a priority for our Government. We will implement a scheme aimed at the socio-economic upliftment of urban workers, focused on improving income, ensuring sustainable livelihoods, and enhancing quality of life.

PM SVANidhi

50. The PM SVANidhi scheme has positively impacted more than 6.8 million street vendors, providing relief from high-interest informal sector loans. Following this success, we will revamp the scheme with increased bank loan amounts, UPI-linked credit cards with a limit of ₹30,000, and capacity-building support.

Social Security Initiative for Online Platform Workers

51. The contributions of online gig workers play a vital role in the evolving services economy. In recognition of their significant input, our Government will facilitate their registration and the issuance of identity cards through the e-Shram portal. Additionally, these workers will have access to healthcare under the PM Jan Arogya Yojana, benefiting approximately 1 crore gig workers.

B. Economic Investment Strategies

Public-Private Partnerships in Infrastructure

52. Each ministry pertaining to infrastructure will develop a three-year project pipeline that can be executed via Public-Private Partnership (PPP) models. States will also be encouraged to create their own pipelines and can seek assistance from the India Infrastructure Project Development Fund (IIPDF) to help draft their PPP proposals.

Support for State Infrastructure Development

53. We propose an allocation of ₹ 1.5 lakh crore in interest-free loans over 50 years for states aimed at capital expenditures and reform incentives.

Asset Monetization Strategy 2025-30

54. Following the success of the initial Asset Monetization Plan rolled out in 2021, we will launch a second plan for 2025-30, aimed at reinvesting ₹ 10 lakh crore into new projects. Regulatory and fiscal adjustments will be implemented to support this initiative.

Jal Jeevan Mission

55. Since its launch in 2019, the Jal Jeevan Mission has successfully provided potable tap water connections to 15 crore households, covering 80% of India’s rural population. To move toward complete coverage, I am pleased to announce the extension of the Mission until 2028, with an increased budget allocation.

56. Our mission centers on enhancing the quality of infrastructure and the operation and maintenance (O&M) of rural water supply systems through active community participation, or “Jan Bhagidhari.” We will create individual Memoranda of Understanding (MoUs) with states and Union Territories to guarantee sustainable, citizen-centered water service delivery.

Urban Sector Reforms

57. Building upon the proposals from the July Budget, we will incentivize reforms in urban governance, municipal services, land use, and planning.

Urban Challenge Fund

58.The Government is gearing up to establish a substantial Urban Challenge Fund worth ₹ 1 lakh crore. This initiative aims to support projects that transform cities into vibrant growth hubs and promote innovative redevelopment. Additionally, it will complement ongoing efforts to improve water and sanitation services, as highlighted in the July Budget.

59. This fund will cover up to 25% of the costs for viable projects, requiring at least 50% of the funding to come from bonds, bank loans, and PPPs. An allocation of ₹ 10,000 crore is proposed for the fiscal year 2025-26.

Reforms in the Power Sector

60. We aim to encourage reforms in electricity distribution and enhance the intra-state transmission capacity through state initiatives. This will bolster the financial health of electricity companies. Furthermore, we will permit an additional borrowing capacity of 0.5% of GSDP for states, contingent upon implementing these reforms.

Nuclear Energy Mission for Viksit Bharat

61. To support our energy transition goals, it’s crucial to develop at least 100 GW of nuclear energy by 2047. In pursuit of this objective, we will work on amending the Atomic Energy Act and the Civil Liability for Nuclear Damage Act to foster an active partnership with the private sector.

62. A dedicated Nuclear Energy Mission will be established, focusing on the research and development of Small Modular Reactors (SMR), with a budget allocation of ₹20,000 crore. We aim to operationalize a minimum of five indigenous SMRs by 2033.

Shipbuilding

63. The Shipbuilding Financial Assistance Policy will be revised to mitigate cost disadvantages and will include Credit Notes for shipbreaking in Indian yards, thereby promoting a circular economy.

64. Large ships exceeding a specified size will be added to the infrastructure harmonized master list (HML).

65. We will facilitate the development of Shipbuilding Clusters to enhance ship range, categories, and capacity. This initiative will also focus on improving infrastructure, skilling, and technology to nurture the complete ecosystem.

Maritime Development Fund

66. To provide long-term financial support for the maritime industry, we will establish a Maritime Development Fund with a total corpus of ₹25,000 crore. This fund will enable distributed support and foster competition, with government contributions of up to 49%, while the rest will be sourced from ports and the private sector.

UDAN – Regional Connectivity Scheme

67. The UDAN scheme has fulfilled the travel aspirations of 1.5 crore middle-class individuals by connecting 88 airports and launching 619 routes. Building on this success, a revamped UDAN scheme will be introduced to improve regional connectivity to 120 new destinations, aiming to transport 4 crore passengers over the next decade. The scheme will also extend support to helipads and smaller airports in hilly, aspirational, and North East regions.

Greenfield Airport in Bihar

68. We will facilitate the establishment of greenfield airports in Bihar to meet the state’s future requirements. This initiative will complement the capacity expansion of Patna airport and include a brownfield airport at Bihta.

Western Koshi Canal Project in Mithilanchal

69. Financial backing will be provided for the Western Koshi Canal ERM Project, benefiting numerous farmers who cultivate over 50,000 hectares of land in the Mithilanchal region of Bihar.

Mining Sector Reforms

70. Reforms in the mining sector, encompassing minor minerals, will be promoted through the sharing of best practices and the introduction of a State Mining Index.

71. A new policy will be introduced to enhance the recovery of critical minerals from tailings.

SWAMIH Fund 2

72. The Special Window for Affordable and Mid-Income Housing (SWAMIH) has successfully completed fifty thousand dwelling units in stressed housing projects, with keys handed over to homebuyers. Looking ahead, an additional forty thousand units are projected for completion in 2025, offering vital support to middle-class families who are juggling EMIs for loans taken out for apartments while paying rent for their current homes.

73. Building on this achievement, SWAMIH Fund 2 will be launched as a blended finance initiative, drawing contributions from the Government, banks, and private investors. With a total allocation of ₹15,000 crore, this fund aims to expedite the completion of another 1 lakh housing units.

PM Gati Shakti Data for Private Sector

74. To promote public-private partnerships (PPPs) and assist the private sector in project planning, access to valuable data and maps from the PM Gati Shakti portal will be made available.

Tourism for Employment-led Growth

75. The top 50 tourist destinations across the country will be developed in collaboration with state governments through a competitive challenge. States will be responsible for providing land for key infrastructure development, while hotels in these areas will be included in the infrastructure HML.

76. The following initiatives will be implemented to foster employment-led growth:

1) Launching comprehensive skill-development programs for our youth, including offerings from Institutes of Hospitality Management;

2) Providing MUDRA loans to support homestays;

3) Enhancing ease of travel and connectivity to tourist destinations;

4) Implementing performance-linked incentives for states to ensure effective destination management, focusing on tourist amenities, cleanliness, and marketing strategies; and

5) Introducing streamlined e-visa facilities with visa-fee waivers for specific tourist groups.

77. Maintaining a focus on sites of spiritual and religious significance as highlighted in the July Budget, we will pay special attention to destinations associated with the life and teachings of Lord Buddha.

Medical Tourism and Heal in India

78. Medical Tourism and Heal in India will be actively promoted in collaboration with the private sector, alongside efforts for capacity building and simplified visa regulations.

Investing in Innovation

Research, Development, and Innovation

79. To support a private sector-led initiative in Research, Development, and Innovation announced in the July Budget, I am allocating ₹20,000 crore.

Deep Tech Fund of Funds

80. We will also explore the establishment of a Deep Tech Fund of Funds to stimulate the next generation of startups as part of this overarching initiative.

PM Research Fellowship

81.In the next five years, the PM Research Fellowship scheme aims to offer 10,000 fellowships dedicated to technological research at IITs and IISc, along with improved financial backing.

Gene Bank for Crop Germplasm

82.A second Gene Bank will be established, containing 1 million germplasm lines to ensure future food and nutritional security. This initiative will provide vital conservation support to both public and private sectors in managing genetic resources.

National Geospatial Mission

83.We are launching a National Geospatial Mission to create foundational geospatial infrastructure and data. Utilizing the PM Gati Shakti framework, this mission will enhance modernization of land records, facilitate urban planning, and aid in the design of infrastructure projects.

Gyan Bharatam Mission

84.The Gyan Bharatam Mission will be initiated to survey, document, and conserve our manuscript heritage in collaboration with academic institutions, museums, libraries, and private collectors, aiming to encompass over 10 million manuscripts. We will establish a National Digital Repository of Indian knowledge systems to promote knowledge sharing.

85.Exports as the Fourth Engine

Export Promotion Mission

86.We will launch an Export Promotion Mission, establishing sectoral and ministerial objectives driven in collaboration by the Ministries of Commerce, MSME, and Finance. This mission will ensure easier access to export credit, cross-border factoring support, and assistance for MSMEs in navigating non-tariff measures in international markets.

BharatTradeNet

87.We will set up ‘BharatTradeNet’ (BTN), a digital public infrastructure for international trade, serving as a unified platform for trade documentation and financing solutions. This initiative will complement the Unified Logistics Interface Platform and will be designed to align with international standards.

Support for Integration with Global Supply Chains

88.Support will be provided to enhance domestic manufacturing capabilities to facilitate our economy’s integration with global supply chains. Sectors will be identified through objective criteria.

89.Facilitation groups comprising senior officials and industry representatives will be established for select products and supply chains.

90.This initiative opens significant opportunities tied to Industry 4.0, which demands advanced skills and talent—resources abundant among our youth. Our Government is committed to empowering the domestic electronic equipment industry to harness this opportunity for the benefit of our young population.

National Framework for GCC

91. A national framework will be developed to guide states in promoting Global Capability Centres in emerging tier 2 cities. This framework will propose measures to improve talent availability, enhance infrastructure, reform building bylaws, and establish collaboration mechanisms with the industry.

Warehousing Facility for Air Cargo

92. Our Government will support the upgrading of infrastructure and warehousing for air cargo, particularly for high-value perishable horticulture products. We will streamline cargo screening and customs protocols to make them more user-friendly.

Reforms as the Fuel

93. Now, let’s delve into ‘Reforms as the Fuel’ with specific details on these reforms.

Tax Reforms

94. Over the past decade, our Government has introduced multiple reforms to enhance taxpayer convenience, including (1) faceless assessment, (2) a taxpayer charter, (3) faster return processing, (4) nearly 99 percent of returns on self-assessment, and (5) the Vivad se Vishwas scheme. Continuing these efforts, I reaffirm our tax department’s commitment to “trust first, scrutinize later.” Additionally, I will introduce a new income-tax bill next week, with specific details on indirect tax reforms and changes in direct taxes to follow in Part B.

Financial Sector Reforms and Development

FDI in Insurance Sector

95. We will raise the Foreign Direct Investment (FDI) limit for the insurance sector from 74 to 100 percent. This new limit will apply to companies investing the entire premium in India, and we will review and simplify the current regulations and conditions associated with foreign investment.

Expanding Services of India Post Payment Bank

96. We will deepen and expand the services of India Post Payment Bank in rural areas.

Credit Enhancement Facility by NaBFID

97. NaBFID is set to establish a ‘Partial Credit Enhancement Facility’ for corporate bonds aimed at infrastructure development.

Grameen Credit Score

98. Public Sector Banks will create a ‘Grameen Credit Score’ framework to better serve the credit needs of members of Self-Help Groups (SHGs) and residents of rural areas.

Pension Sector

99. A forum will be established for regulatory coordination and the development of pension products.

KYC Simplification

100. In line with our previous announcement to simplify the KYC process, a revamped Central KYC Registry will be launched in 2025. We will also implement a more streamlined system for periodic updates.

Merger of Companies

101.We will streamline the requirements and procedures for quicker approval of company mergers. The range for fast-tracking mergers will be expanded, and the entire process will be simplified for efficiency.

Bilateral Investment Treaties

102.As highlighted in the Interim Budget, we successfully signed Bilateral Investment Treaties (BIT) with two nations in 2024. To promote ongoing foreign investment and uphold our commitment to ‘first develop India’, we will revamp the current model BIT to make it more appealing to investors.

Regulatory Reforms

103.Over the past decade, our Government has shown unwavering dedication to enhancing the ‘Ease of Doing Business’ across various sectors, both financial and non-financial. We are committed to ensuring our regulations evolve alongside technological advancements and global policy changes. A light-touch regulatory framework built on principles and trust will drive productivity and job creation. This framework will involve updating outdated regulations. To create a modern, adaptable, and user-friendly regulatory system fit for the twenty-first century, we propose four specific initiatives:

High-Level Committee for Regulatory Reforms

104.We will establish a High-Level Committee to review all non-financial sector regulations, certifications, licenses, and permissions. This committee is expected to provide recommendations within a year. The goal is to reinforce trust-based economic governance and implement transformative measures that enhance the ‘ease of doing business’, particularly regarding inspections and compliance. States will be encouraged to participate in this initiative.

Investment Friendliness Index of States

105.In 2025, we will launch an Investment Friendliness Index of States to promote competitive cooperative federalism.

FSDC Mechanism

106. A mechanism under the Financial Stability and Development Council will be created to assess the impact of existing financial regulations and subsidiary instructions. This will also include formulating a framework to improve their responsiveness and the overall development of the financial sector.

Jan Vishwas Bill 2.0

107.In line with the Jan Vishwas Act 2023, which decriminalized over 180 legal provisions, our Government will introduce the Jan Vishwas Bill 2.0 to decriminalize an additional 100 provisions across various laws.

Fiscal Policy

108. Moving on to fiscal policy matters.

Fiscal Consolidation

109.In the July Budget, I reaffirmed our commitment to maintaining fiscal consolidation. We will strive to ensure that the fiscal deficit each year keeps the Central Government debt on a declining trajectory as a percentage of GDP. The FRBM statement has detailed the plan for the upcoming six years.

Revised Estimates 2024-25

110. The Revised Estimate for total receipts, excluding borrowings, stands at ₹ 31.47 lakh crore, with net tax receipts totaling ₹ 25.57 lakh crore. The total expenditure is estimated at ₹ 47.16 lakh crore, of which approximately ₹ 10.18 lakh crore is allocated for capital expenditure.

111. The fiscal deficit has been revised to 4.8% of GDP.

Budget Estimates 2025-26

112. Looking ahead to 2025-26, the total receipts excluding borrowings are projected to be ₹ 34.96 lakh crore, while total expenditure is estimated at ₹ 50.65 lakh crore. Net tax receipts are expected to reach ₹ 28.37 lakh crore.

113.The estimated fiscal deficit for this period is 4.4% of GDP.

114. To cover the fiscal deficit, net market borrowings from dated securities are forecasted at ₹ 11.54 lakh crore, with the remainder expected to be sourced from small savings and other avenues. Gross market borrowings are projected to be ₹ 14.82 lakh crore.

Next, I will proceed to Part B.

PART B

Indirect Taxes

115. My proposals concerning Customs are aimed at streamlining the tariff structure and tackling duty inversion. These initiatives will bolster domestic manufacturing, enhance value addition, promote exports, facilitate trade, and ultimately provide relief to everyday citizens.

Rationalization of Customs Tariff Structure for Industrial Goods

116. As part of the thorough review of the Customs rate structure announced in the July 2024 Budget, I propose the following:

(i) Eliminate seven tariff rates, in addition to the seven rates that were removed in the 2023-24 budget. This will leave only eight tariff rates in place, including the ‘zero’ rate.

(ii) Implement a suitable cess to largely maintain the effective duty incidence, with a few exceptions where this incidence will see a slight reduction.

(iii) Limit the imposition to a maximum of one cess or surcharge. Accordingly, I propose to exempt the Social Welfare Surcharge on 82 tariff lines that are currently subject to a cess.

117. Now, I will address sector-specific proposals.

Relief on Import of Drugs/Medicines

118. To alleviate the burden on patients, particularly those battling cancer, rare diseases, and other serious chronic conditions, I propose including 36 lifesaving drugs and medicines in the roster of items fully exempted from Basic Customs Duty (BCD). Additionally, I recommend adding six lifesaving medicines to the list that will be subject to a concessional customs duty of 5%. The same full exemption and concessional duty will apply to the bulk drugs used in the manufacture of these medicines.

119. Under the Patient Assistance Programme operated by pharmaceutical companies, specified drugs and medicines will remain fully exempt from BCD, provided they are supplied free of cost to patients. I propose to add 37 more medicines and 13 new patient assistance programmes to this initiative.

Support to Domestic Manufacturing and Value Addition

Critical Minerals

120. In the July 2024 Budget, I had granted full exemption from BCD on 25 critical minerals that are unavailable domestically. Furthermore, I had reduced BCD on two additional minerals to significantly boost their processing, particularly by MSMEs. I now propose to fully exempt cobalt powder, lithium-ion battery scrap, Lead, Zinc, and an additional 12 critical minerals. This move will ensure their availability for manufacturing in India and create more job opportunities for our youth.

Textiles

121.To support the growth of local production in technical textiles, including agro-textiles, medical textiles, and geo-textiles at competitive prices, I recommend incorporating two additional types of shuttle-less looms into the category of textile machinery that are fully exempt. Furthermore, I propose a revision of the Basic Customs Duty (BCD) on knitted fabrics spanning nine tariff lines, changing the rate from “10% or 20%” to “20% or ₹115 per kg, whichever is higher.”

Electronic Goods

122.In keeping with our ‘Make in India’ initiative and to address the inverted duty structure, I recommend increasing the BCD on Interactive Flat Panel Displays (IFPD) from 10% to 20% while simultaneously reducing the BCD to 5% for Open Cell and other related components. 123.In the 2023-24 Budget, I had previously lowered the BCD on parts of Open Cells for LCD/LED televisions from 5% to 2.5%. To further encourage the production of these Open Cells, these parts will now be exempt from BCD entirely.

Lithium Ion Battery

124.I propose to include an additional 35 capital goods relevant to EV battery manufacturing and 28 for mobile phone battery production on the list of exempted items. This move aims to enhance domestic manufacturing of lithium-ion batteries for both mobile phones and electric vehicles.

Shipping Sector

125.Given that shipbuilding involves a lengthy development period, I recommend extending the BCD exemption on raw materials, components, consumables, or parts used in ship manufacturing for another ten years. The same exemption would apply to shipbreaking to boost its competitiveness.

Telecommunication

126.To resolve classification disputes, I propose reducing the BCD from 20% to 10% on Carrier Grade Ethernet switches, aligning them with Non-Carrier Grade Ethernet switches.

Export Promotion

Handicraft Goods

127.To support the export of handicrafts, I propose extending the export timeframe from six months to one year, with an additional three-month extension available if necessary. Additionally, I would like to include nine new items on the list of duty-free inputs.

Leather Sector

128.I propose a full BCD exemption on Wet Blue leather to facilitate imports that support domestic value addition and job creation. I also recommend exempting crust leather from the 20% export duty to benefit small tanners in their export efforts.

Marine Products

129.To strengthen India’s position in the global seafood market, I propose reducing the BCD from 30% to 5% on Frozen Fish Paste (Surimi) to promote the manufacture and export of similar products. Furthermore, I suggest reducing the BCD from 15% to 5% on fish hydrolysate for the production of fish and shrimp feeds.

Domestic MROs for Railway Goods

130.In the July 2024 Budget, we aimed to boost the development of domestic Maintenance, Repair, and Overhaul (MRO) services for aircraft and ships by extending the export timeframe for foreign-origin goods imported for repairs from six months to one year, with a possible one-year extension. I now propose applying the same extension to railway goods.

Trade Facilitation

Time Limit for Provisional Assessment

131.Currently, the Customs Act of 1962 lacks a definitive timeframe for finalizing Provisional Assessments. This can cause uncertainty and increased costs for those involved in trade. To enhance the ease of doing business, I propose establishing a time limit of two years for completing these assessments, with the possibility of extending it by one additional year if necessary.

Voluntary Compliance

132.To encourage voluntary compliance, I recommend introducing a provision that allows importers or exporters to voluntarily declare essential information and pay the requisite duty along with interest, without incurring any penalties, after their goods have been cleared. However, this option will not be available if the department has already started audit or investigation proceedings.

Extended Time for End Use

133.To help industries better plan their imports, I propose extending the time limit for the end-use of imported inputs from six months to one year. This change will provide greater operational flexibility amid cost fluctuations and supply uncertainties. Additionally, importers will only need to submit quarterly statements, rather than monthly ones, streamlining the reporting process.

Direct Taxes

I would like to present my proposals regarding direct taxes.

134. In Part A, I want to highlight the importance of taxation reforms as an essential part of our vision for a developed Bharat (Viksit Bharat). Recently, our Government introduced the Bharatiya Nyaya Sanhita, replacing the older Bharatiya Danda Sanhita, reflecting our commitment to reform. I am pleased to announce that the new income tax bill will embody this spirit of “Nyaya.” It aims to simplify the language and provisions of the current law, cutting nearly half of the existing text, which will benefit both taxpayers and the tax administration with greater clarity and less litigation.

135. It’s important to note that reforms should not be viewed as an endpoint but as a pathway to achieving effective governance for our citizens and our economy. Good governance means being responsive to the needs of our people. Our Government is dedicated to listening to voices from across the nation and taking action while continuing our efforts in nation-building. The following measures will outline how, under PM Modi’s leadership, we are addressing the concerns expressed by our citizens. My tax proposals are inspired by this approach.

136. The core objectives of my proposals include:

(i) Reforms in personal income tax with a focus on the middle class

(ii) Rationalization of TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) to ease compliance challenges

(iii) Promotion of voluntary compliance

(iv) Reduction of compliance burdens

(v) Enhancements in the ease of doing business

(vi) Boosting employment and investment

I will touch upon personal income tax proposals toward the end.

Rationalization of TDS/TCS for Ease of Compliance

137. I propose to simplify the Tax Deduction at Source (TDS) structure by reducing the number of rates and raising the thresholds for TDS deductions. Additionally, the threshold for tax deduction on interest for senior citizens will increase from ₹50,000 to ₹1 lakh. The annual TDS limit on rent will also be raised significantly from ₹2.40 lakh to ₹6 lakh, which will reduce the number of transactions subject to TDS, benefiting small taxpayers.

138. For remittances under the RBI’s Liberalized Remittance Scheme (LRS), I propose to increase the TCS threshold from ₹7 lakh to ₹10 lakh and remove TCS on educational remittances if funded through loans from specified financial institutions.

139. Currently, TDS and TCS apply to transactions related to the sale of goods, leading to compliance challenges. To alleviate this, I propose to omit the TCS in these cases and specify that the higher TDS deduction will apply solely to non-PAN transactions.

140. In July 2024, we decriminalized delays in TDS payments until the filing date of the statement. I propose extending this same leniency to TCS provisions as well.

Encouraging Voluntary Compliance

141.The Government, led by Prime Minister Modi, advocates the principles of “Sabka Saath, Sabka Vikas, Sabka Vishwas, and Sabka Prayas.” In line with these values, we introduced an updated return facility in 2022, enabling taxpayers who had not accurately reported their income to come forward and amend their declarations. Our faith in the taxpayers’ willingness to comply was well-placed, as nearly 9 million individuals opted to voluntarily update their income by remitting additional tax. Building on this trust, we’re now proposing to extend the timeframe for filing updated returns from the existing two years to four years for any assessment year.

Reducing Compliance Burden

142.We aim to ease the compliance obligations for small charitable trusts and institutions by extending their registration period from five years to ten years. We also plan to ensure that minor oversights, like incomplete applications from charitable entities, do not attract disproportionate penalties.

143.Currently, taxpayers can only report the annual value of self-occupied properties as nil if they meet specific criteria. To alleviate the challenges faced by taxpayers, we propose to allow the benefit of claiming two self-occupied properties without any conditions.

Ease of Doing Business

144.To optimize the process of transfer pricing and offer an alternative to annual assessments, we will introduce a scheme for determining the arm’s length price of international transactions over a three-year block period, adhering to global best practices.

145.To minimize disputes and foster certainty in international taxation, we are broadening the scope of the safe harbour rules.

146.Many senior citizens have old National Savings Scheme accounts that are no longer yielding interest. To support them, we plan to exempt withdrawals from these accounts for individuals starting on August 29, 2024. We’ll also extend comparable treatment to NPS Vatsalya accounts, mirroring provisions for standard NPS accounts, within established limits.

147.During my address in July 2024, I promised that all processes, including implementation of appellate orders, would transition to a digital and paperless format within two years. I am pleased to share that we are moving forward with this digital transformation.

148.In July 2024, we introduced the Vivad Se Vishwas Scheme aimed at resolving pending income tax disputes. The scheme has garnered significant attention, with approximately 33,000 taxpayers taking advantage of it to settle their matters.

Employment and Investment

149. I have several proposals designed to promote investment and employment.

Tax Certainty for Electronics Manufacturing Initiatives

150. We aim to implement a presumptive taxation framework specifically for non-residents offering services to Indian companies in the electronics manufacturing sector. Additionally, we plan to introduce a safe harbour provision to ensure tax certainty for non-residents who store components designated for particular electronics manufacturing units.

Tonnage Tax Scheme for Inland Vessels

151. Presently, the tonnage tax scheme is limited to sea-going vessels. We propose to expand this scheme’s benefits to inland vessels registered under the Indian Vessels Act, 2021, with the objective of fostering growth in inland water transport throughout the country.

Extension for Incorporation of Start-Ups

152. We remain committed to supporting the Indian start-up ecosystem. To further this commitment, we propose extending the incorporation period by an additional five years, allowing start-ups established before April 1, 2030, to take advantage of the available incentives.

International Financial Services Centre (IFSC)

153. To boost activities within the IFSC, we are suggesting specific benefits for ship-leasing units, insurance offices, and treasury centres established by global companies in this enclave. Moreover, we are extending the cut-off date for commencing operations within the IFSC by five years to March 31, 2030, enabling more entities to claim these advantages.

Alternate Investment Funds (AIFs)

154. Category I and Category II AIFs are playing a pivotal role in investing in infrastructure and other sectors. We intend to clarify the taxation framework for these entities concerning gains from securities.

Date Extension of Investment for Sovereign and Pension Funds

155. To encourage investments from Sovereign Wealth Funds and Pension Funds in the infrastructure domain, we propose extending the investment deadline by five additional years, now set to March 31, 2030.

Personal Income Tax Reforms with a Focus on the Middle Class

156. Democracy, Demography, and Demand are fundamental pillars in our vision for a developed Bharat. The middle class is a crucial driving force behind India’s economic growth. Under Prime Minister Modi’s leadership, we have consistently recognized the significant role of the middle class in nation-building. In acknowledgment of their contributions, we have progressively lightened their tax burden. Following our reforms in 2014, the ‘Nil tax’ threshold was lifted to ₹2.5 lakh, increased again to ₹5 lakh in 2019, and raised to ₹7 lakh in 2023. This shows our unwavering trust in the middle-class taxpayer. I am pleased to share that under the new tax regime, there will be no income tax on earnings up to ₹12 lakh (about ₹1 lakh per month, excluding special rate income like capital gains). For salaried taxpayers, this limit will be ₹12.75 lakh, taking the standard deduction of ₹75,000 into account.

157. We’re making significant changes to the tax slabs and rates to ensure that all taxpayers see the benefits. This new structure is designed to greatly reduce taxes for the middle class, leaving more funds in their hands, which will enhance household consumption, savings, and investment.

158. Under the proposed tax regime, I suggest revising the tax rate structure as follows:

| Income Range (₹) | Tax Rate (%) |

|---|---|

| 0 – 4 lakh | Nil (0%) |

| Above 4 lakh – 8 lakh | 5% |

| Above 8 lakh – 12 lakh | 10% |

| Above 12 lakh – 16 lakh | 15% |

| Above 16 lakh – 20 lakh | 20% |

| Above 20 lakh – 24 lakh | 25% |

| Above 24 lakh | 30% |

159. For taxpayers earning up to ₹12 lakh in regular income (excluding special rate income like capital gains), a tax rebate will be provided alongside the benefits from reduced tax slabs, ensuring that they pay no tax at all. It’s important to illustrate how the total tax benefits from slab rate changes and rebates work out at various income levels. For instance, someone earning ₹12 lakh will see a tax benefit of ₹80,000, equating to 100% of the tax owed according to current rates. A person with an income of ₹18 lakh will benefit by ₹70,000, which is 30% of what they would have had to pay previously. Additionally, an individual earning ₹25 lakh will enjoy a benefit of ₹1,10,000, or 25% of their tax obligation based on existing rates.

160. More details about these tax proposals can be found in the Annexure.

161. As a result of these changes, we anticipate a revenue shortfall of about ₹1 lakh crore in direct taxes and ₹2,600 crore in indirect taxes.

Budget 2025-2026

Budget 2025-2026 the complete Nirmala Sitharaman budget Speech

Complete Speech Here : https://www.indiabudget.gov.in/doc/budget_speech.pdf

Budget 2025-2026 related updates

Stock Market Updates Here : https://visionarydaily.in/

Budget 2025-2026 related updates

Budget 2025-2026

I know this if off topic but I’m looking into starting my own weblog and was wondering what all is needed to get set up? I’m assuming having a blog like yours would cost a pretty penny? I’m not very internet savvy so I’m not 100 sure. Any tips or advice would be greatly appreciated. Appreciate it

You could certainly see your enthusiasm in the work you write. The world hopes for more passionate writers like you who aren’t afraid to say how they believe. Always go after your heart.

Really appreciate your encouraging words! We’ll keep bringing more content with passion. Stay connected!

Like a gentle breeze in the heat of day, your words bring clarity, calm, and a renewed sense of wonder.

Thanks for another informative web site. Where else could I get that kind of info written in such an ideal way? I’ve a project that I am just now working on, and I have been on the look out for such info.

Hmm is anyone else encountering problems with the pictures on this blog loading? I’m trying to figure out if its a problem on my end or if it’s the blog. Any suggestions would be greatly appreciated.